3 Debt Tendencies and How To Overcome Them

3 Debt Tendencies and How to Overcome Them

Debt is borrowing money that is not yours. It typically comes at a cost, known as interest. Interest is a percentage of the amount owed. Debt comes with expected payments and an expectation to replay all that you borrowed plus interest.

Even financially savvy people can find themselves in too much debt leaving them feeling vulnerable or uncomfortable. A good rule of thumb is to maintain a long-term perspective. We need to learn to delay short-term pleasures in order to reach long-term goals.

The 3 debt tendencies are…

- Ignorance or carelessness about our financial reality

- Coveting and comparing ourselves with others

- Impulsive and emotional spending

Ignorance or Carelessness About Our Financial Reality

Sometimes being “past feeling: may cause us to choose to ignore the reality of our situation. We may want to avoid tracking expenses or looking at our bank accounts because it’s too overwhelming or we don’t understand what we are looking at. If we use credit cards or other consumer debt, carelessness can quickly lead us into debt.

Why are some inclined to ignore the reality of their situation? Ignorance is bliss, until reality hits you in the face. It can be easy to ignore if you don’t monitor your credit card statements regularly or tend to swipe your card without a thought. Some want to show a perception of financial affluence and would rather incur debt than live within their means and go without. Whatever the reason, ignoring your reality is setting you up for future failure.

Coveting and Comparing Ourselves with Others

It’s natural for people to compare themselves with others, and we are bombarded with messages and advertisements encouraging us to purchase things we do not need. Sometimes we feel entitled to have things that we can’t afford or don’t really need. Giving in to coveting can quickly lead us to make unwise purchases that push us further into debt. Do you really need that designer handbag? Could your yard improve by a quick clean up versus a pricey landscape renovation? Stop following people on social media that make you feel the need to compare their “haves” to your “have nots”. Make a conscious choice to be grateful for the things you do have.

Impulsive and Emotional Spending

Unnecessary purchases often boil down to a lack of impulse control or filling an emotional need. For impulse buys, it can often be solved by creating a shopping list in advance and then sticking to it. If you’re shopping in an emotionally vulnerable state, I invite you to not. Before you log on to amazon or head to the strip mall, stop for a moment and think about why you’re shopping. Are you bored, lonely, sad…? Deal with the emotion behind the need to buy. If the craving doesn’t stop, fill your time with something else. Read a book, do a puzzle, or watch a show.

So You’re In Debt, Now What?

You CAN get out of debt! Aggressively paying down debt will require sacrifice, but you can do it. Here are 4 important principles for getting out of debt.

- Desire to Get Out of Debt

In order to do anything difficult, including getting out of debt, your desires must be stronger than the obstacles. To find success, focus on your goal to get out of debt and visualize what life will be like when you are free from the burden of debt.

- Understand Your Debt Realities

Before you can pay off your debts, you must be honest about your debt realities. How much debt do you have? What are the interest rates? What are the payments? How long will it take you to pay off your debt, and how much interest will it cost you?

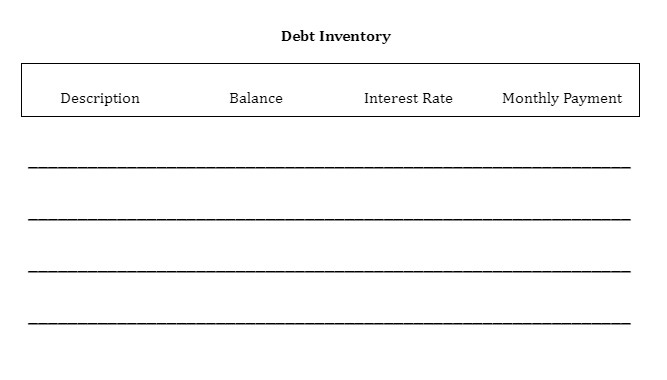

- Complete a Debt Inventory

Write it out so you can visually compare your debts. Just put pen to paper. If you need guidance on how to lay it out, feel free to copy the debt inventory tracker below.

- Decide to Pay Extra Towards Your Debts

One of the most expensive ways to get out of debt is to make minimum payments. To get out of debt more quickly, you will need to pay more than the minimum payment.

Consider This:

If you had a credit card with a balance of $4,000, and an interest rate of 17% and a minimum monthly payment of $97. Paying only the minimum payment, it would take you 20 years and 9 months to pay it off and it would cost you $5,107.62 in interest.

That same credit card, if you paid the $97 plus an extra $100 per month, would be paid off in 2 ½ years. That’s 18 years sooner! You would save $4,357.49 in interest.

2 ways to get started:

| Method | Advantages | Disadvantages |

| Highest Interest First | • Eliminates most expensive debts earlier | • Could take longer to reduce the number of creditors • Delayed psychological wins |

| Lowest Balance First | • Reduces number of creditors more quickly· • Reduces number of minimum payments more quickly • Provides quicker psychological wins | • Could be more expensive since you aren’t paying off the debts with the highest interest first |

Tip! Use the Rollover Method

When you finish paying off one debt, take the amount you were putting towards it and use it to pay off another debt quicker.

Take Additional Steps

If you are having a difficult time making minimum debt payments, then you may need to take additional measures.

- Take a second job or do a side business while you get back on your feet

- Sell something you can live without

- downsize: sometimes your best move is to actually move. A less expensive home or apartment could relieve some of your financial burden allowing you to put more towards paying off debt.

- Refinance debt: In some circumstances, it is possible to refinance your loans or consolidate debts. Proceed with caution as there can be costs associated with doing this.

- Stop incurring new debt: You cant expect to get our of debt until you stop incurring more debt.

However you decide to go about it, I wish you luck on your debt repayment journey.

Sincerely,

Amanda

Be sure to follow over on Instagram for future post updates and other fun content!