Tips To Help You Raise Financially Competent Children

I feel extremely grateful to have grown up in the financial world. Especially when adulting hit and I quickly found that most of my friends had very little idea about money. We can reflect all day on who should be responsible for teaching these concepts, but at the end of the day, parents have the most vested interest in their child’s well-being. The problem I’ve seen is that many parents still aren’t comfortable with financial concepts themselves. My financial blog section is dedicated to educating people on various financial concepts. If you’re not sure about something, reach out to me. I’d love to be helpful in any way that I can.

Wherever you are personally with your financial knowledge, let me help you baby step your children towards financial confidence.

Start With A Plan

Money planning, aka budgeting, is an age-old tactic that most people either don’t want to do or don’t know how to do. It doesn’t have to be complicated, though some may prefer a more comprehensive accounting. When teaching your children, keep it simple and expand as they get older and more comfortable.

Money doesn’t have to be taboo within families. Raise your kids to be comfortable talking about money. It is one of the biggest causes of conflict in relationships. Your kids will be much better off learning how to have those conversations now. Watching you and your partner, or you on your own navigate finances can be so empowering for our little ones.

Many families provide allowances for their kids. Some connect allowances to chores and others offer a set amount per week. What you choose to do and why, is 100 percent your decision. Just determine how you want to do it and how you will implement it. For reference, here is how we do it in our home.

For me, household chores are an essential part of running a home and everyone in the home is expected to do their part. When my kids were toddlers, that meant simple tasks like cleaning up their toys, wiping up a spill, or putting clothes into drawers. All of that with my help. Now that they’re older, they still do those tasks but independently. My oldest is learning to vacuum, they both help with non breakable dishes, and they help dust and wipe down surfaces. These are tasks they do without monetary compensation. They are just part of living in a home.

We always provide the necessities and many extras for our kids. We don’t tie their allowance to a chore at this point. As a starting point, I introduce the concept of budgets and allowance around age 6. This is usually when they begin learning about the value of money in school. We do a dollar per year old, per week. So a 6 year old would get $6 per week and so on. Recently, my daughter told me she wanted to buy catchers gear. I told her if she saved up half, we would pay for the other half. To help her with this goal, we created non essential chores that she can do to earn extra money. Recently, my daughter told me she wanted to buy catchers gear. I told her if she saved up half, we would pay for the other half. To help her with this goal, we created non essential chores that she can do to earn extra money.

When I was a child, I kept all of my change in my room and loved sorting and counting it out. Unfortunately, my son swallowed a penny last year, so I hang on to their money for the time being. I just really don’t want another hospital overnight. We will revisit where its kept once he is a little older and I can trust the coins will not go in his mouth.

INTRODUCING THE CONCEPT

I started introducing budgeting when my daughter was 4. She would get some gift cards and cash for birthdays or holidays. I would take her to the store and tell her she had as an example, $15 to spend on whatever she wanted. She would pick things out and I would tell her if it was in her budget. As she learned her numbers in order, she knew she could choose anything smaller than $15. If it went a little over the budget, I would just cover it. Sure I’m teaching her about budgeting but she was also 4 so I wasn’t going to be a stickler about the overage.

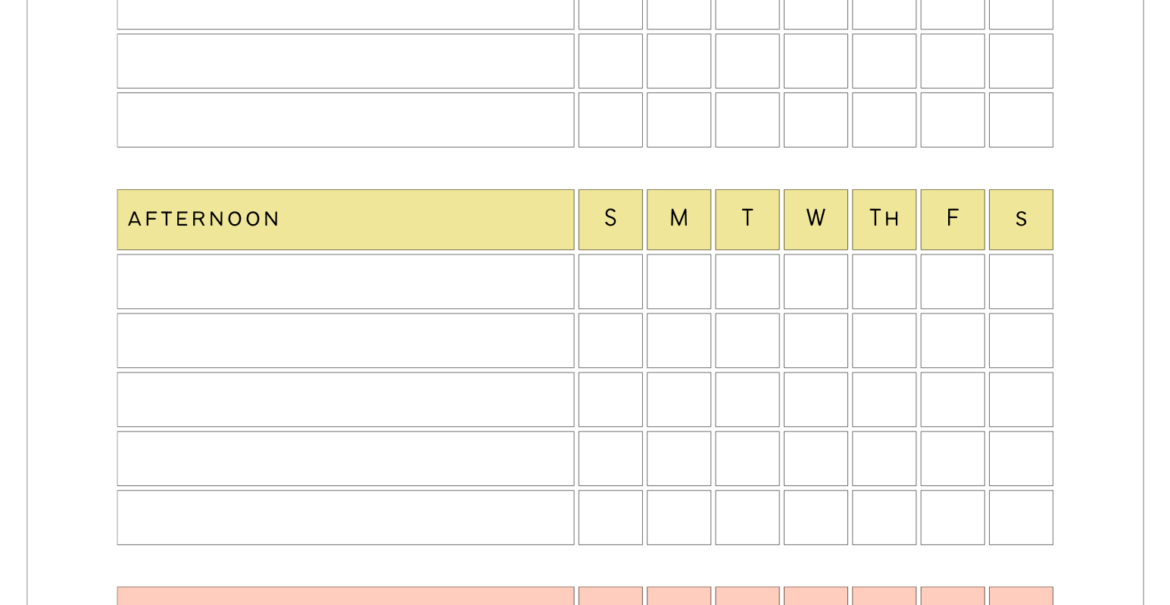

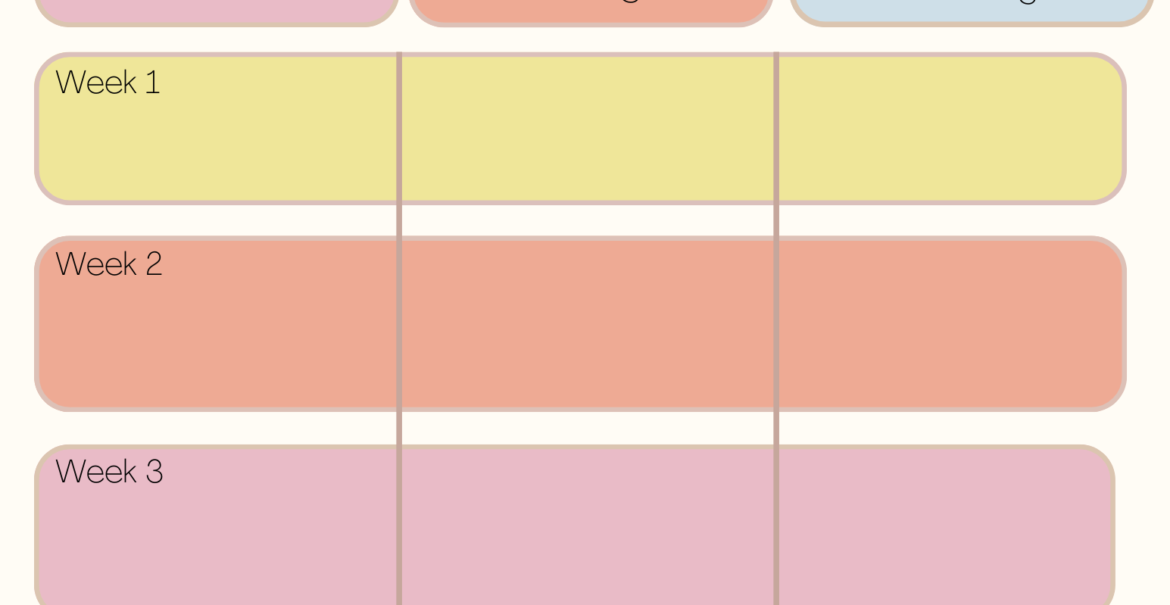

Now that she has learned about addition and subtraction, we are able to expound on financial concepts even more. As a bonus, we put math skills to every day use! We use a monthly chart we use to help her keep track of her money. It has 3 categories, money added, money subtracted, and total balance. What is so great about this, is she can practice her counting using manipulatives, in this case, money!

This simplified method works as your kids get older too. You can expound on this by helping them set financial goals and teach them basic financial principles. Once they are confident in the basics of budgeting, you and introduce the 80/10/10 rule. In adult world, this means no more than 80% of our income goes to bills and other spending (obviously we hope for less),10% to savings and 10% to charity. Since our children don’t have bills, I tweak this to 80% goes to short-term saving/spending money, 10% to long-term savings and 10% to charity.

You can set them up with a savings account at the bank for their long-term savings and provide a system at home to help with the short-term savings. They could decorate and label mason jars, use an envelope system, cash box, or any other alternative you might think would work for them. They can save their charity money until they have a big lump sum, or donate in small increments. Do whatever works in your home.

In our home, we believe in enjoying the moment and preparing for the future. That starts with a plan and self-control.

Extra Money

Here is something that even grown ups have trouble knowing what to do with. Whenever we get extra money in our lives, it’s hard not to just spend it! Applying the 80/10/10 rule, or just throwing it all towards savings are both viable options. If you don’t have a plan for it, you will likely blow it. Here are some strategies we have implemented for our children with any bonus money that comes in to their lives.

My in-laws are so generous. Every time my mother in law comes across a dollar bill that begins with a specific letter, she puts it in a jar for each one of her grandkids and gives them the jar full on their birthdays. She also generously spoils them with gifts on their special days. Since the bucket of money is not their primary present, we match the amount and put the money into an UTMA account we created for each of our kids. We chose an UTMA because we wanted the flexibility for any future plans, not just college. However, a high yield savings account, 529 plan, or other accounts would work too. Find what works for your wants and needs.

All other money my kids get during the year, be that Birthday, Easter, Christmas, Tooth Fairy, etc. is theirs to spend, save, or give as they wish. My goal in doing the above, is to help my kids be best prepared for the future. To learn the value in saving long term and not just gratifying ones wants in the moment. The money is still 100% theirs and will hopefully help them begin their adult years with stable footing.

Next Steps

If you implement these basic financial ideas into your kids life, they are already light years ahead of most of their peers. If you found this article helpful, I hope you will share it with others. If you are looking for some financial enhancement of your own, I recommend reading Retirement Account Cheat Sheet and 10 Financial Terms You Should Know.

Sincerely,

Amanda

Join me over on Instagram for future post updates!